Do's and Dont's for Raising Your Credit Score Fast

Do's and dont's [15Tips]

When your credit may not be as good as you would like, the thought of fixing it yourself can be daunting. Although some may have vague notions that credit repair only involves communicating with credit bureaus, more informed consumers understand that enduring results require leveraging applicable consumer rights with your creditors as well. Or perhaps you may have read the online myth that credit repair isn’t possible because only time can fix bad credit.

While the truth is that some credit repair approaches may require some study, there are many other things you can easily do to improve your credit that may not be as difficult as you think. Every monetary decision you make can influence your credit rating. There are many things a person can do in the day-to-day management of finances that can improve his or her credit score without embarking on an all-out improvement campaign.

Here are 20 simple dos and don’ts for getting your credit rating in the best shape (and none of them involve sending out letters):

- Do pay all of your bills on time. According to myfico.com, your payment history makes up 35 percent of your credit score. Even one late payment can lower your score dramatically.

- Don’t close any credit card accounts just before you apply for a loan. Credit utilization, the amount of all revolving debt divided by your overall credit lines, accounts for 30% of your score, according to myfico.com. The more credit you have available to use, the lower your credit utilization. The lower your credit utilization, the higher your score. When you have more credit available, you have a better chance of getting a desirable interest rate on the loan. Wait until after you secure the loan to close the card.

- Do close store cards if you must close any accounts — unless those cards are your oldest accounts (see tip #4). In addition, the limit on store credit cards is often very low, as little as $500. At such a low limit, carrying a balance of $300 puts your credit utilization at 60%, which lowers your score.

- Don’t close your oldest credit cards. Part of the credit rating formula is longevity. Fifteen percent of your FICO score is the average age of all your trade lines, according to myfico.com.

- Do open a credit card if you don’t already have one. Having new credit accounts for 10 percent of your score, according to myfico.com. If you’ve never had a credit card before or your credit is a little spotty, you may be able to open a secured card with a deposit. Shop around for the best terms – interest rates and deposit requirements vary widely. Make sure that any card you wind up getting reports to the credit bureaus so you get credit for timely payments.

- Don’t open multiple new cards at the same time. Each time you apply for new credit, an inquiry is placed on your credit report, which can lower your score by anywhere from 2 to 20 points, depending upon the number and frequency of applications. Additionally, your average account age will be shortened.

- Do be conservative when using your credit cards. Credit Karma performed a study in 2009 that showed that people using 30% or less of their available credit had the highest scores. Try using your card for things that are a part of your normal monthly expenditures such as gas and groceries. In this way, you will have budgeted the money for such items and can pay down your card balance in full.

- Do set up alerts through your credit card’s website. If you have difficulty keeping track of expenditures, you can set up email or text notifications to warn you when you’ve reached a certain limit.

- Do set up automatic payments to creditors. On credit card accounts, I recommend making an automatic payment every two weeks of at least your minimum payment. Not only will you be guaranteed to avoid late fees, but also you’ll never have to worry about a delinquent payment on your credit report. In addition, you will be putting extra money towards your balance, helping you to decrease your credit utilization (review tip #2 again).

- Don’t pay below your minimums on credit cards. Even if you are making the payment on time, paying less than the minimum counts as a late pay. Why? You are making less than the agreed payment, and until the bank receives the entire amount, the payment is not counted as received.

- Do call your lenders to have your credit limits increased. Increasing your limit decreases your credit utilization, which increases your credit score. Even if you have a secured card, you might be eligible for a credit line increase if you’ve been making timely payments.

- Do call your lenders and ask for your interest rates to be decreased. Having lower interest rates will help you to pay off your debt sooner, decreasing your credit utilization.

- Do protect your information from fraud and identity theft. Sign your card as soon as you receive it, shred statements before disposing of them, and keep a list of phone numbers for all of your lenders in case your wallet gets stolen.

- Do review your credit reports at least once per year to make sure you aren’t a victim of identity theft. Having items listed on your credit report that aren’t yours can negatively affect your credit rating. You are entitled to one free report each from Equifax, Experian, and Transunion per year at annualcreditreport.com. If you notice accounts that aren’t yours, you can call the fraud assistance centers at each credit bureau. They will take you though the process of helping you remove fraudulent accounts.

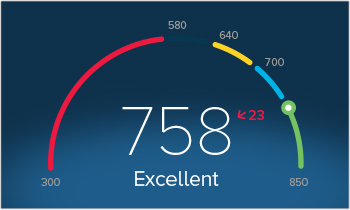

- Do request copies of your credit scores at least a few months before making any major purchases, such as a home. This will allow you to take simple steps now to help get your credit in the best shape for that loan down the road.

- Don’t transfer a balance to an account with a lower limit, as this will increase your credit utilization.

- Don’t transfer balances from several cards to one card – no matter how good the interest rate. It may help your bottom line, but it will increase your credit utilization for that card. Generally, it’s more favorable to have a few small balances than to max out a single card with one big balance. Credit scores take into account both individual card utilization ratios as well as the overall ratio described in tip #3 above.

- Don’t assume that neglecting bills that are not reported to a credit bureau, like utilities and library fines, is allowable. Should these bills go delinquent, they might be sent to a collection agency. The biggest motivating tool for getting paid used by collection agencies is reporting the delinquent account to the credit bureaus. Anything reported by a collection agency can sink your rating.

- Don’t procrastinate. If a creditor calls about a bill that you owe, pay the bill before it goes into default and sent out for collection.

- Do create a plan to pay down your debts and stick to it. Not only does carrying a high balance on a credit card cost you lots of money in interest, it also drags down your score. To pay down balances as fast as possible, pay off debts with the highest interest rates first.